Iraqi Naphtha is a light hydrocarbon fraction produced from crude oil refining and condensate splitting. It is a versatile feedstock used across petrochemical, gasoline blending, solvent, and chemical industries. Key properties that determine naphtha performance and market value include density, octane ratings (RON, MON, AKI), aromatic and olefin content, oxygenate content (notably ethanol), distillation profile (IBP, T10, T50, T90, FBP), vapor pressure (DVPE), and sulfur level. Oil-Load produces multiple naphtha grades in the Kurdistan Region of Iraq tailored to buyers’ technical and regulatory needs.

Naphtha plays a quiet but crucial role in the global energy and petrochemical value chains. At Oil-Load, produced in the Kurdistan Region of Iraq, naphtha is not a single commodity but a family of tailored feedstocks engineered to meet buyers’ technical needs and regulatory constraints. This blog post unpacks what makes Oil-Load naphtha competitive, explains the practical implications of key specifications, and shows how buyers can match product choice to end use for smoother logistics and better margins.

What is naphtha and why it matters today

Iraqi Naphtha by Oilload is a light hydrocarbon cut used as:

A feedstock for steam crackers and petrochemicals,

A blending component for gasoline,

A solvent or raw material for specialty chemicals.

Its value depends on measurable properties such as sulfur content, aromatic fraction, octane numbers, vapor pressure, and distillation behavior. Small changes in these parameters can substantially affect product suitability, downstream processing costs, and regulatory compliance. Oil-Load produces three main commercial grades — zero sulfur, sulfur up to 350 ppm, and sulfur up to 750 ppm — and blends to customer specifications to hit precise technical windows.

Naphtha Zero sulfur grade — for markets requiring ultra-low sulfur feedstocks (petrochemicals, certain refinery blending).

Naphtha Sulfur up to 350 ppm — intermediate grade for general refinery use and export markets with moderated sulfur limits.

Naphtha Sulfur up to 750 ppm — industrial grade where higher sulfur is acceptable and cost sensitivity is primary.

Each grade can be further customized for aromatics, ethanol/oxygenate content, and distillation targets according to buyer specifications. Oil-Load combines local feedstock access with flexible blending and QC to meet global shipping and contractual requirements.

Key technical parameters of Naphtha explained (what buyers should watch)

Sulfur (wt% / ppm) Sulfur drives downstream processing cost. Low- and zero-sulfur grades command premiums in markets where desulfurization capacity or emissions limits are strict.

Aromatics and Benzene (Vol%) Aromatics raise octane but also raise health and emissions concerns. Benzene is tightly regulated, so benzene limits are often specified separately.

Olefins and Oxygenates (Vol%) Olefins affect gum formation and polymerization risk. Oxygenates (notably ethanol) change vapor pressure and water affinity; ethanol-rich streams require tank and logistics considerations.

Octane Ratings (RON, MON, AKI) Important for gasoline blending: higher RON/MON increases blending value. Oil-Load’s samples typically sit in the mid-80s RON range — useful for many blending recipes.

Distillation Profile (IBP, T10, T50, T90, FBP) These temperatures define volatility and cracking behavior. Tighter distillation windows improve predictability in petrochemical yields.

DVPE / Vapor Pressure (kPa) Vapor pressure determines transport classification and seasonal acceptability for blending.

Density @15.6°C Useful for custody transfer and energy content calculations.

How Oil-Load Naphtha grades align with end uses

Petrochemical feedstock (steam cracking): Choose low-sulfur, controlled-aromatics naphtha with predictable distillation cuts and low oxygenates. Oil-Load’s near-zero sulfur blends and controlled T50/T90 windows make them suitable for crackers and high-value chemical plants.

Gasoline blending: Higher aromatic fractions provide octane but need balancing with paraffinic streams. Oil-Load can deliver mid-range octane naphthas with defined aromatics to fit refinery blending recipes.

Industrial solvents / specialties: Low olefin, low oxygenate variants are best. Oil-Load offers tailored cuts for solvent makers and industrial users.

Cost-sensitive export markets: The higher-sulfur grade (up to 750 ppm) reduces raw material cost for buyers prepared to handle desulfurization locally or where sulfur limits are looser.

Reviewed Oilload's Naphtha Production in Iraq

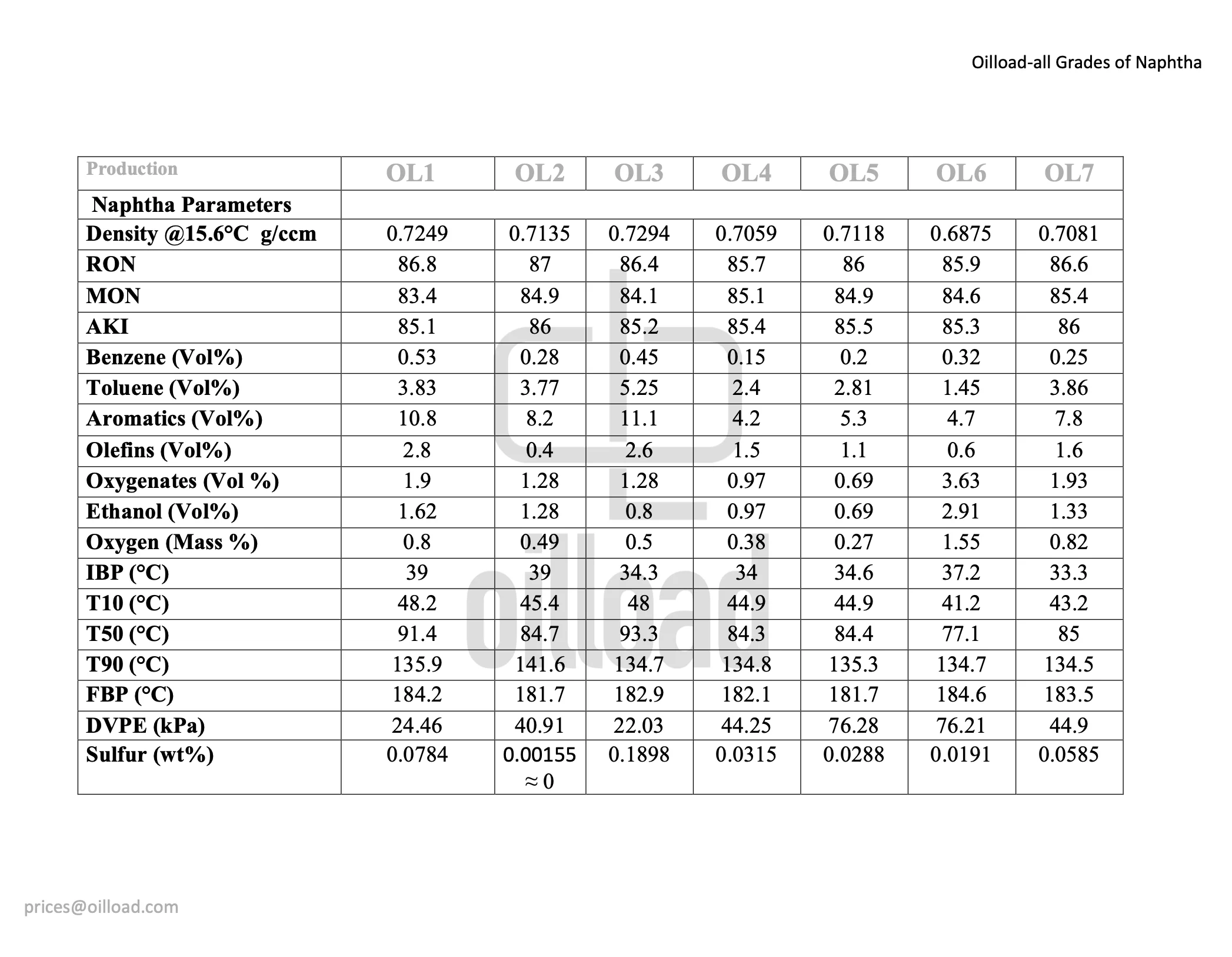

The above production table lists seven sample naphtha products (Samples 1–7 Produced by Oilload). Below are the most relevant observations and what they mean for buyers and handlers.

Key measured ranges across samples

Density @15.6°C: 0.6875–0.7294 g/ccm. Lower density generally indicates lighter paraffinic naphtha; higher density correlates with higher aromatics content and higher energy per volume.

RON / MON / AKI: RON 85.7–87.0; MON 83.4–85.4; AKI 85.1–86.0. These octane ratings place the samples in typical gasoline blending naphtha range; small differences affect gasoline blending value.

Aromatics (Vol%): 4.2–11.1%. Higher aromatics increase octane but raise environmental concerns and affect petrochemical yields for some processes.

Olefins (Vol%): 0.4–3.6%. Olefins can impact gum formation in gasoline blending and affect polymer feedstock quality.

Oxygenates / Ethanol (Vol%): oxygenates 0.69–3.63%; ethanol 0.69–2.91%. Presence of ethanol/oxygenates affects vapor pressure, distillation, and compliance with fuel regulations.

Distillation profile:

IBP: ~33–39°C; T50: ~77–93°C; T90: ~134–142°C; FBP: ~181–185°C. These define volatility and suitability for petrochemical feed or blending.

DVPE (kPa): 22.03–76.28 kPa. Vapor pressure influences storage, transport (IMO/ADR classifications), and gasoline blending volatility.

Sulfur (wt%): ~0.0000155 (Zero)–0.1898 wt% (roughly 0 ppm–1898 ppm). This wide spread reflects samples from near-zero sulfur to higher sulfur products.

Interpretation of notable OILLOAD'S samples

Naphtha Sample OL2: Very low sulfur (≈0.00155 wt% ≈ 15.5 ppm≈ 0 ppm), low olefins, moderate aromatics — suited for petrochemical feedstock or markets with strict sulfur limits.

Naphtha Sample OL3: Highest aromatics (11.1%) and higher sulfur (0.1898 wt% ≈ 1898 ppm) — higher octane contribution but may require desulfurization for strict markets.

Naphtha Sample OL6: Lowest density (0.6875), relatively high oxygenates and ethanol — implies blend with ethanol-rich stream; lower aromatic content suitable where lighter feed is preferred.

DVPE extremes: Samples 5 and 6 show high DVPE (~76 kPa) — higher vapor pressure needs careful handling for export and may influence summer/winter blend acceptance.

How Naphtha Specifications Map to Use Cases

Petrochemical feedstock (steam cracker): Prefer low sulfur, controlled aromatics, low oxygenates, tight distillation cut to ensure predictable yields. Samples with low sulfur (Sample Oilload 2) and moderate aromatics are preferable.

Gasoline blending component: Octane (RON/MON) and aromatics matter. Higher aromatics raise octane but may increase emissions and regulatory penalties. Samples with AKI closer to 86 and higher aromatics (Oilload Sample 3, Oilload Sample 1) are useful blends but may require balancing with paraffinic streams.

Industrial solvents and specialty chemicals: Require controlled olefin/oxygenate profiles and low sulfur. Samples with low olefins and oxygenates are better suited.

Export to price-sensitive markets: Higher sulfur grades (up to 750 ppm) reduce cost but may face additional duties or processing constraints.

Quality Control and Naphtha Customization Services by Oil-Load in Iraq and Kurdistan Region (Erbil / Sulaymaniyah)

Oil-Load offers:

Flexible blending to achieve target sulfur, aromatic, olefin, and ethanol specifications.

Distillation cut tailoring to hit specific IBP—FBP and Txx targets for client processes.

Vapor pressure (DVPE) management to meet shipping, storage, and seasonal volatility requirements.

Full QC reports with standard methods for density, sulfur, compositional analysis (GC), and octane numbers, enabling buyers to include these in contractual specifications.

Why choose Oil-Load for Iraqi naphtha

Flexible grading: Zero, ≤350 ppm, and ≤750 ppm sulfur grades, plus custom blends.

QC and documentation: Full lab reporting and density-corrected custody transfer practices.

Local Logistics: Naphtha Land Transportation Department, storage in Persian Gulf sea ports (BIK etc.), transshipment at land borders including Haji Omran (Tamrchin), Bashmaq, Parviz Khan.

Contract readiness: Oil-Load supports contract specification blocks, CoA templates, and sampling protocols suited for FOB shipments.

Call to action

If you need a tailored naphtha grade or a contract-ready specification sheet for FOB shipments to China, UAE, or Africa, India contact Oil-Load to request product sheets and CoA templates. Tell us your target sulfur limit, acceptable aromatic window, DVPE limit, and intended end use — we will propose the best-fit grade and provide a commercial package ready for negotiation.